Recruitment – Filling in Your Five-Year Work History Form

As part of BS7858 screening, we review your education, employment, and other activities for

the past 5 years. Please ensure you select the correct ‘activity type’ for each entry to describe

what you were doing.

Tips:-

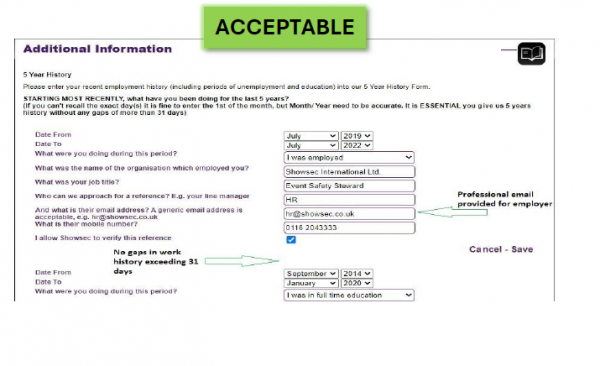

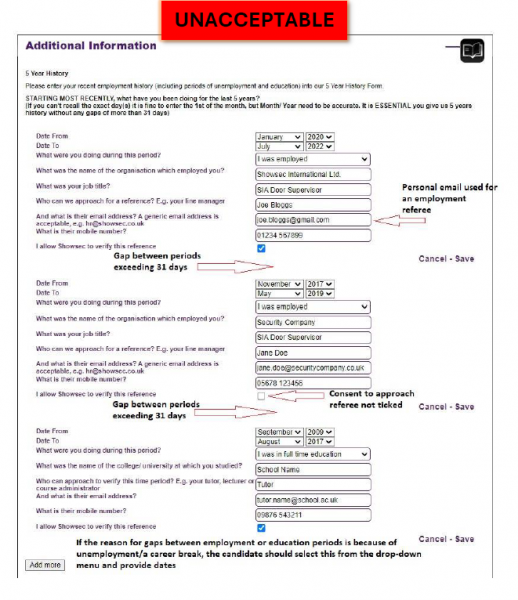

o For the first entry, you need to start with the most recent activity period from the

present day and work your way back to five years ago – remember to click ‘Save’ on

each entry.

o You must provide a professional/organisation email address for periods of

employment, self-employment, or education. If this is absolutely not possible, you will

need to contact the Recruitment department and they will advise you.

o Ensure you do not leave any gaps between periods. If you were unemployed or on a

career break, you must declare this.

o You do not need to provide a reference for unemployment or career breaks: the

Screening team will contact you at a later stage to request evidence of your activity (e.g.

job searching or travelling).

Please note, we are only requesting confirmation of dates from your referees, we do not ask for

opinions on capability or conduct.